Child Tax Credit 2024 Increase – and 2025 tax years. Furthermore, the maximum refundable credit amount is slated to increase to $1,800 for 2023, $1,900 for 2024, and $2,000 for 2025. The overall child tax credit maximum will also be . The utmost refundable portion of the CTC is projected to increase from the current $1,600 per child to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025, according to the framework. .

Child Tax Credit 2024 Increase

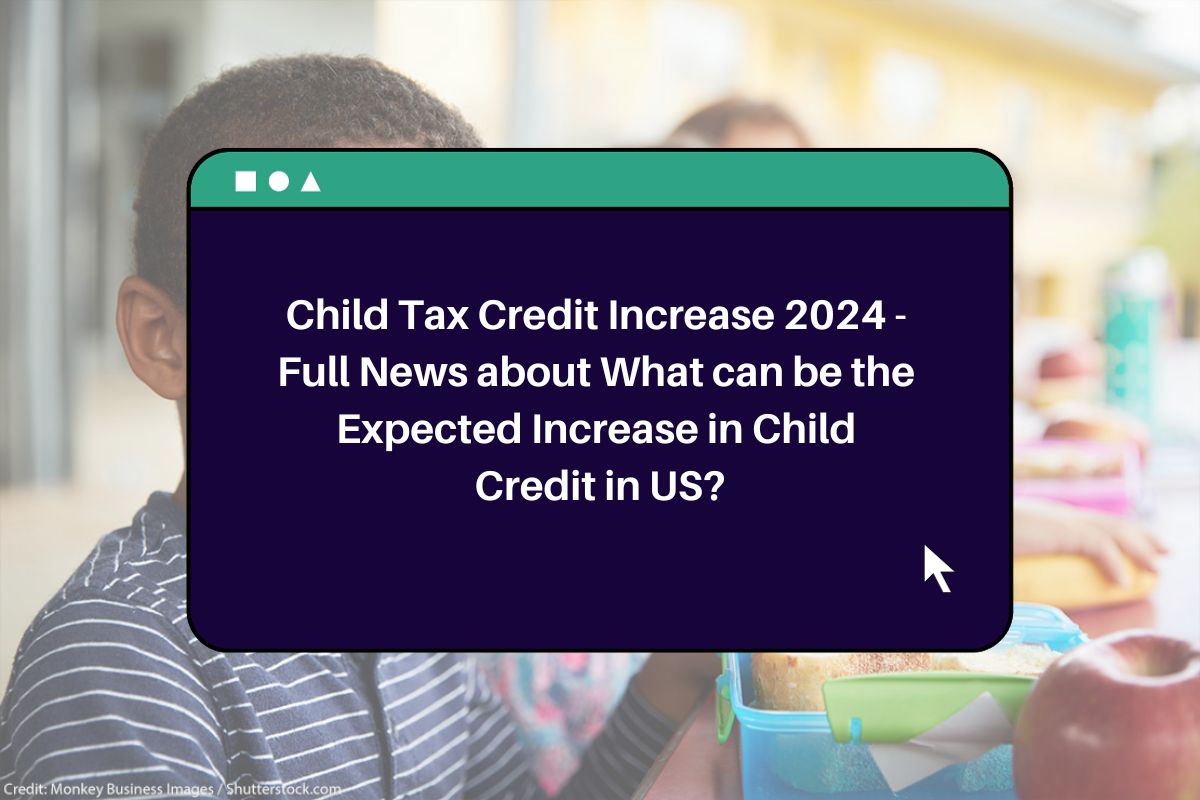

Source : itep.org

Child Tax Credit Boost in USA What Can be the Increase in Child

Source : matricbseb.com

Child Tax Credit 2024 Updates: Who will be eligible to get an

Source : www.marca.com

Child Tax Credit Boost in USA What Can be the Increase in Child

Source : matricbseb.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Bipartisan deal to expand child tax credit, revive business tax

Source : nebraskaexaminer.com

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

Child Tax Credit Increase 2024 Full News about What can be the

Source : matricbseb.com

Child tax credit expansion, business incentives combined in new

Source : kansasreflector.com

Child Tax Credit Increase 2024 Full News about What can be the

Source : matricbseb.com

Child Tax Credit 2024 Increase Expanding the Child Tax Credit Would Help Nearly 60 Million Kids : The new proposal supported by the Republicans would change the design of the credit to develop the qualifications Around 90% of the proposed child tax break changes are pointed toward increasing . The new agreement proposes to raise the maximum refundable tax credit from $1,600 to $1,800 per child for 2023, with further increases planned for 2024 and 2025. Additionally, starting in 2024, the .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)